COLA

Cost of Living Adjustment (COLA)

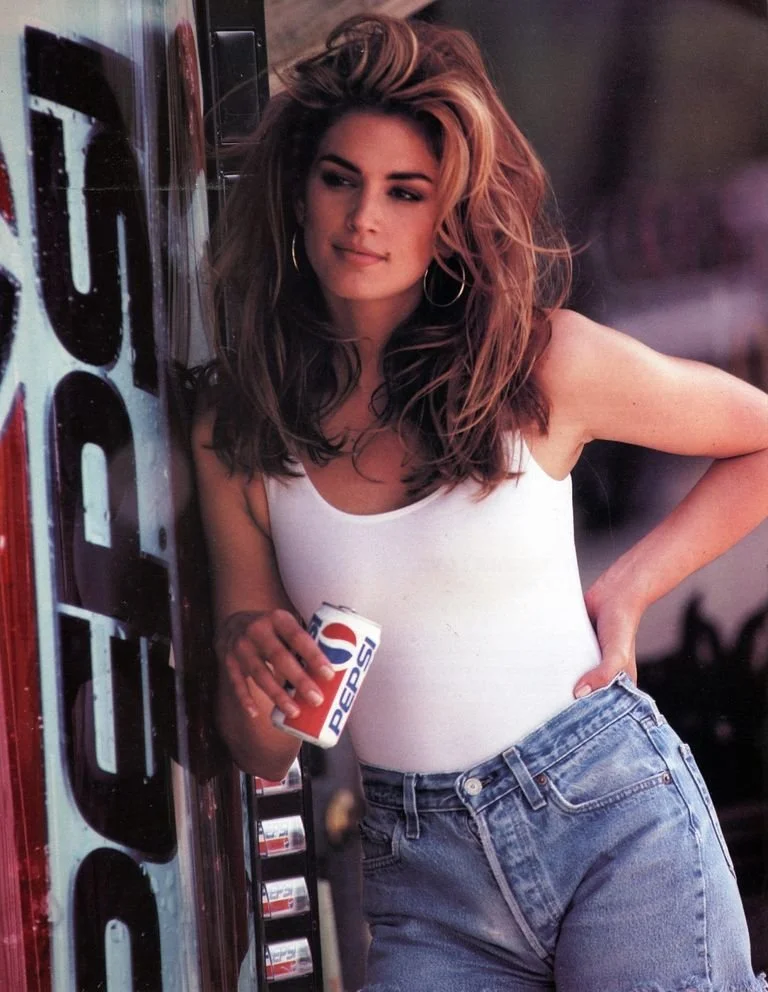

Sorry, this is not a blog post about the COLA Wars of the 1980s with the Michael Jackson and Cindy Crawford Pepsi Ads or the bizarre Max Headroom New Coke ads. Instead, let’s cover the Cost Of Living Adjustment and how you can use it to maintain the profit margins of your practice.

A COLA is put in place to ensure that benefits, wages and fees keep up with inflation and you will hear it most commonly used with annual Social Security increases. To make matters more confusing, each government agency uses a different COLA calculation. For example, the Social Security Administration uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) while military uses the Cost Of Living Allowance In The Continental United States (CONUS COLA). Just like retirees and military personnel need adjustment to keep up with the cost of living increases, your practice needs inflationary adjustments.

Your Patient Fees - If you don’t raise your fees to keep up with inflation, you will essentially be making less money for the same amount of work. First, your practice costs like supplies and lab bills are increasing and reduce the amount of profit you can take from the practice. Second, the profit you do take from the practice will buy you less personally. For example (numbers are theoretical and for demonstration purposes only), if your crown fee was $1,500 five years ago and is the same today:

Your direct costs have increased by at least 25%. Therefore, the $100 you paid in 2020 for the lab crown is now $125. That is $25 less in profit you are taking home just on the direct costs. Add in labor and overhead costs and it gets worse.

Your per crown profit in 2020 was $500. Now when we factor in a 25% increase across all cost that profit is only $250. Inflation has effectively cut your profit, which is how you pay yourself, in half.

Your spouse spent about $500 a week on groceries in 2020, which used to one crown on your schedule per week. But now that means two and half crowns as each crown is less profitable and $500 in 2020 groceries now costs $625.

To keep up with inflation, you must adjust your fees every year so that you are maintaining your practice profit margin and your personal spending power.

Your Team’s Wages - Your team is definitely feeling the effects of inflation when they go to the store as well and there are few ways to help them deal with it:

You can use this method that I saw on a dental chat board “Ignore them. If they ask, you ask them why they think they deserve a raise. If the answer is ‘due to increased cost of living’, say that is not a very good reason. If they have a good reason, say ‘I'll think about it’ then ignore them.” If you enjoy high team turnover and disgruntled employees then this a great way to go.

You can wait until they ask for a raise and then try and figure out when the last raise was, what the inflation rate has been since then and if they have developed new skills. Then present them with an offer and hope they are happy.

You can establish a practice wide wage calendar with a specific annual COLA and achievement raise dates. We recommend an annual COLA increase on January 1st of each year and performance raises on each team member’s anniversary dates. The performance raise is given if the team member has achieved the metrics established at the prior year’s performance review.

To maintain a happy and productive team, thinking about giving them some COLA every year for the holidays.

For both the Fee and Wage increases, you can use any inflationary index that you like but the simplest and most common COLA is the CPI-U available from the Bureau of Labor Statistics.